lamponisilver.ru News

News

Margin Call In Trading

In the context of energy commodities trading, as with other forms of trading, a margin call is a request from a broker to an investor to deposit additional. A margin call is triggered when an investor trading on margin has an account value below the minimum requirement. A margin account is a method for investors to. A margin call is a broker demand requiring the customer to top up their account, either by injecting more cash or selling part of the security. A margin call occurs when trading account equity falls, requiring additional funds to cover potential losses and protect available capital. Margin. Leveraged trading is sometimes referred to as 'trading on margin', because only a margin is actually invested by the trader to open the position. In forex trading, the Margin Call Level is when the Margin Level has reached a specific level or threshold. When this threshold is reached, you are in danger of. Watch to learn what to do if you get a margin call and how to potentially avoid them. What Are the Requirements for Pattern Day Traders? First, pattern day traders must maintain minimum equity of $25, in their margin account on any day that. A margin call is the kind of call no investor or trader wants to get. When you invest or trade in a margin account, you borrow money to buy or sell stocks. In the context of energy commodities trading, as with other forms of trading, a margin call is a request from a broker to an investor to deposit additional. A margin call is triggered when an investor trading on margin has an account value below the minimum requirement. A margin account is a method for investors to. A margin call is a broker demand requiring the customer to top up their account, either by injecting more cash or selling part of the security. A margin call occurs when trading account equity falls, requiring additional funds to cover potential losses and protect available capital. Margin. Leveraged trading is sometimes referred to as 'trading on margin', because only a margin is actually invested by the trader to open the position. In forex trading, the Margin Call Level is when the Margin Level has reached a specific level or threshold. When this threshold is reached, you are in danger of. Watch to learn what to do if you get a margin call and how to potentially avoid them. What Are the Requirements for Pattern Day Traders? First, pattern day traders must maintain minimum equity of $25, in their margin account on any day that. A margin call is the kind of call no investor or trader wants to get. When you invest or trade in a margin account, you borrow money to buy or sell stocks.

Margin calls are a risk management tool used by brokers to prevent traders from incurring losses that exceed the value of their account. A margin call is when it goes down so much that you lost all your money and the bank takes what's left. Then, you'll have to top off your trading account with fresh funds until you reach the needed maintenance margin. This capital may take the form of cash or new. A margin call, also known as a margin stop, is a protective measure that helps traders to manage their risk and prevent additional losses. · The limit level is. A margin call occurs when the value of the account falls below a certain threshold. When this happens, the investor must add more money in order to satisfy the. Margin call is the term for when the equity on your account – the total capital you have deposited plus or minus any profits or losses – drops below your. A margin call is an investor's need to add more securities or funds to their margin account to raise it above the minimum maintenance margin initiated by. Margin call is when the equity on your account—the total capital you have deposited plus or minus any profits or losses—drops below your margin requirement. You. What is a margin call? The broker makes margin calls when equities in the MTF account falls below the maintenance margin. The MTF account contains securities. When the value of your account drops below margin requirement, this results in a margin call, putting your positions at risk of being closed. Learn more. A Margin Call occurs when the value of the investor's margin account drops and fails to meet the account's maintenance margin requirement. An investor will need. A margin call is a request for extra funds or securities to be deposited into a margin account to bring it back up to the required level of maintenance. A margin call is the term used to describe the alert sent to a trader to notify them that the capital in their account has fallen below the minimum amount. A margin call is a demand from your brokerage firm to increase the amount of equity in your account to meet margin requirements. Learn more. What Are the Requirements for Pattern Day Traders? First, pattern day traders must maintain minimum equity of $25, in their margin account on any day that. Margin trading increases your level of market risk. Your downside is not limited to the collateral value in your margin account. Schwab may initiate the sale of. If you buy on margin and the value of your securities declines, your brokerage firm can require you to deposit cash or securities to your account immediately. A margin maintenance call is when your portfolio value (minus any crypto positions) falls below your margin maintenance requirement. Margin calls are due immediately: You must meet the call by depositing enough cash or marginable securities in your margin account to avoid account liquidation. A margin call is a demand from an asset lender to increase the amount of assets held as collateral in a trading account using borrowed funds.

What Home Insurance Is Cheapest

Nationwide homeowners insurance discounts. Nationwide offers many ways to lower your rate with homeowners insurance discounts. One of the easiest ways to save. Information on home/residential insurance --homeowners Insurance Industry, Community Affordable Housing and Economic Development Organizations, and Community. Cheap house insurance doesn't need to compromise quality. Check out Mercury's affordable homeowner's insurance with first-class coverage. Get a quote! Affordable Home Insurance Inc. We believe that insurance is a people business. At Affordable Home Insurance, you're not a number. We pledge to listen, learn. USAA and Auto-Owners are the cheapest home insurance companies on average, according to Bankrate's research. There are no state-mandated requirements for homeowners coverage, as there are for auto insurance in most states. What's more, a mortgage lender may require you. Learn how to get cheap home insurance with Progressive. Get an affordable rate on your existing policy or find the cheapest home insurance. Generally you get the same insurance so generally the lower price makes the most sense. The truth is in the details which come down to. Bankrate can help you understand how much home insurance costs in Nationwide homeowners insurance discounts. Nationwide offers many ways to lower your rate with homeowners insurance discounts. One of the easiest ways to save. Information on home/residential insurance --homeowners Insurance Industry, Community Affordable Housing and Economic Development Organizations, and Community. Cheap house insurance doesn't need to compromise quality. Check out Mercury's affordable homeowner's insurance with first-class coverage. Get a quote! Affordable Home Insurance Inc. We believe that insurance is a people business. At Affordable Home Insurance, you're not a number. We pledge to listen, learn. USAA and Auto-Owners are the cheapest home insurance companies on average, according to Bankrate's research. There are no state-mandated requirements for homeowners coverage, as there are for auto insurance in most states. What's more, a mortgage lender may require you. Learn how to get cheap home insurance with Progressive. Get an affordable rate on your existing policy or find the cheapest home insurance. Generally you get the same insurance so generally the lower price makes the most sense. The truth is in the details which come down to. Bankrate can help you understand how much home insurance costs in

Allstate homeowners insurance helps protect your house and your family. Get a home insurance quote, find coverage options, and more. The Colorado Division of Insurance has created this Homeowners Insurance Interactive Premium Comparison Report to provide consumers an opportunity to compare. How much does homeowners insurance cost? The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from. A home insurance policy provides coverage to repair or replace your home Cheapest Homeowners Insurance Companies · Best Home and Auto Insurance Bundles. Progressive is the cheapest home insurance for $, in dwelling coverage by almost $ The next cheapest is Nationwide and then Erie. Amica is our No. 1 cheapest homeowners insurance company with an average monthly premium of $ for $, in dwelling and $, in liability. Homeowners insurance at Lemonade starts at $25/month, but varies by state and depends on factors including your house's age, the cost to rebuild, and building. Shop around · Raise your deductible · Don't confuse what you paid for your house with rebuilding costs · Buy your home and auto policies from the same insurer. So, is house insurance cheaper without a mortgage? The answer is yes, but there is a risk involved. If you do not have house insurance, then you must pay for. The national average homeowners insurance cost is $ and has been steadily increasing each year. ✓ Get details and learn how to keep costs down! Home Insurance Rate Comparison. Rate Comparison Chart (Updated 08/) Keep These Basics in Mind. This guide lists annual rates for four typical homeowners. Cheap home insurance companies. State Farm and Erie have the best home insurance quotes. State Farm costs $1, per year and is available in most states. Erie. Protect your home and belongings with State Farm homeowners insurance. First time homeowners, get details of what you need for a free online quote today. Insurify has found that Commonwealth Casualty offers the cheapest rates for a policy with a $, dwelling coverage limit. The average monthly premium is $ Save up to 10% on your homeowners premium if you have an auto insurance policy with USAA. Learn more about our auto and home combination discount. See how affordable a homeowners insurance quote can be through the GEICO Insurance Agency. Check out the discount options available to save even more on a home. Freeway Insurance offers convenient ways to shop for home insurance. You can get a low-cost homeowners insurance quote by calling us at or stopping. pay for homeowner's coverage: · Type of Construction: Frame houses usually cost more to insure than brick houses. · Age of House: New homes may qualify for. At Liberty Mutual, you can customize your coverages to get the best homeowners insurance for your home at an affordable price. Start your home insurance quote. At Liberty Mutual, you can customize your coverages to get the best homeowners insurance for your home at an affordable price. Start your home insurance quote.

Cheap Home Solar Energy Setup Company

Why Choose Sunrun in New York? As the nation's leading residential solar, storage, and energy services company,5 we work so you can gain energy freedom and. Residential Solar Installation. Power your home with cost-saving and reliable solar energy through Peninsula Solar's affordable residential services. More. NY-Sun, a dynamic public-private partnership, will drive growth in the solar industry and make solar technology more affordable for all New Yorkers. GoGreenSolar is the leader in DIY solar panel systems. Our DIY solar kits include end-to-end design and installation support from our experts. Rooftop Solar sells and installs solar panels, equipment, and battery power storage in Flagstaff, Sedona, Prescott & Phoenix Arizona. Coquitlam Solar Energy is a home solar, commercial, and industrial solar installation company serving as a premier installer for all your solar requirements. Overall, we recommend you consider SunPower or ADT Solar for your home solar project in New York. The table below includes a quick look at what these providers. The average cost of a kW solar panel installation on EnergySage is $20, after federal tax credits. You'll probably save anywhere from $28,$, Is there a list or comparison of brands/websites that provide the cheapest/best quality solar panels? I want to get completely off grid but want to find out if. Why Choose Sunrun in New York? As the nation's leading residential solar, storage, and energy services company,5 we work so you can gain energy freedom and. Residential Solar Installation. Power your home with cost-saving and reliable solar energy through Peninsula Solar's affordable residential services. More. NY-Sun, a dynamic public-private partnership, will drive growth in the solar industry and make solar technology more affordable for all New Yorkers. GoGreenSolar is the leader in DIY solar panel systems. Our DIY solar kits include end-to-end design and installation support from our experts. Rooftop Solar sells and installs solar panels, equipment, and battery power storage in Flagstaff, Sedona, Prescott & Phoenix Arizona. Coquitlam Solar Energy is a home solar, commercial, and industrial solar installation company serving as a premier installer for all your solar requirements. Overall, we recommend you consider SunPower or ADT Solar for your home solar project in New York. The table below includes a quick look at what these providers. The average cost of a kW solar panel installation on EnergySage is $20, after federal tax credits. You'll probably save anywhere from $28,$, Is there a list or comparison of brands/websites that provide the cheapest/best quality solar panels? I want to get completely off grid but want to find out if.

Installing solar panels: Is it worthwhile? Curious to know what it would cost to install solar panels? Want an estimate of how much energy your solar panels. We are a solar panel system design and installation company, located in Montreal, Qc. Solar solutions for residential, commercial, agricultural sectors. An investment in solar power today for your home or business protects you from rate hikes by utility companies and locks in your electricity rates. The right. Nabu Energy is one of the top solar companies in the Bay Area, dedicated to serving customers in residential, small, and large commercial sectors. We've put together this comprehensive guide to the best solar companies in New York, as rated by our SolarReviews experts and New York residents who've already. installation support of complete solar kits, solar generators, inverters, batteries and more. We help anyone looking for a solar power system for their home. Unbound Solar stocks and delivers a complete solar power system for homes, businesses, boats and RVs, remote industrial and unique applications to utilize solar. Venture Solar is a solar company providing high-efficiency, US-made solar panel installation for homes across the Northeast. Backed by a year warranty. We advocate for rules and policies that make clean energy available and affordable to you. Looking to install solar power at your home, business, or nonprofit. Each solar panel kit comes with solar panels, grid-tie inverters and mounting hardware and is customized to your energy needs and home's unique specifications. Project Solar cuts out the sales person and saves you thousands. Whether you opt for DIY or full service, we hold your hand through the whole process. If you prefer to buy your solar energy system, solar loans can lower the up-front costs of the system. In most cases, monthly loan payments are smaller than a. Home and business owners typically purchase solar panels through solar companies, which are certified to deal and install products from top manufacturers. Why you can trust SolarReviews Despite being a leading clean energy technology, there is still a lot of mystery surrounding installing home solar panels. Tata Power Solar, leading integrated solar player, offers solar rooftop panel for home at affordable price in India #1 Solar Rooftop EPC Company for 8 years. The direction and pitch of your roof are important. The amount of energy produced is impacted by how much sun the panels receive, so shadows, trees, other homes. At Affordable Solar Roof & Air, we pride ourselves on our 5 star rating and excellent customer service. Our solar panels are the most affordable in the area. Solar power systems are very custom based on the home, roof type, shading, and utility. Installation of panels for the average 5kW system ranges from. 12 Solar panels (lamponisilver.ru) system with SMA inverter. Best value package. Starting: $6, ; 12 Solar panels (JA solar) system with Enphase inverter. Most Popular! Power your home Go green and save money with Blue Pacific Solar! We offer affordable solar panel kits and battery storage systems. Online free pricing!

When Looking For Preapproval On A Car Loan You Should

When looking for pre-approval on a car loan you should NOT get a loan from the car dealer directly to keep things simple. Going directly to a car dealer. Pre-approval is when you apply for a loan before you need it. This means that you have the lender look at your finances and credit history and determine. Preapproval is a quick assessment of your ability to pay off a loan based on your credit history and current financial state. If you need to use credit to buy a car, but bad credit is preventing you from getting approved for a car loan, you can take steps to raise your credit score. To get a preapproved auto loan, you'll need to apply online directly with a lender. Your credit score will temporarily drop by a few points when you apply. This gives you the benefit of knowing exactly how much car you can get before you even start shopping. Having this knowledge saves you the time of looking at. When you are shopping, don't mention that you are pre-qualified. Get the deal set first, before you start talking about financing. The. A pre-approval is a first-look evaluation of a potential borrower by a lender, indicating whether they are likely to be approved for a loan. · Lenders use pre-. Getting preapproved for a car loan means that a lender has already approved you for a particular loan amount and interest rate. Examine your budget to account. When looking for pre-approval on a car loan you should NOT get a loan from the car dealer directly to keep things simple. Going directly to a car dealer. Pre-approval is when you apply for a loan before you need it. This means that you have the lender look at your finances and credit history and determine. Preapproval is a quick assessment of your ability to pay off a loan based on your credit history and current financial state. If you need to use credit to buy a car, but bad credit is preventing you from getting approved for a car loan, you can take steps to raise your credit score. To get a preapproved auto loan, you'll need to apply online directly with a lender. Your credit score will temporarily drop by a few points when you apply. This gives you the benefit of knowing exactly how much car you can get before you even start shopping. Having this knowledge saves you the time of looking at. When you are shopping, don't mention that you are pre-qualified. Get the deal set first, before you start talking about financing. The. A pre-approval is a first-look evaluation of a potential borrower by a lender, indicating whether they are likely to be approved for a loan. · Lenders use pre-. Getting preapproved for a car loan means that a lender has already approved you for a particular loan amount and interest rate. Examine your budget to account.

1. A Bank May Preapprove You For A Car Loan, Which Could Save You Thousands. Getting preapproved for your car loan means you know the loan amount. You'll usually be asked to provide the following when looking to prequalify: name, address, income and credit history. Will auto loan prequalification affect my. Getting pre-approved before you arrive at the dealership can make the experience more enjoyable. That's because you'll already have the information you need to. The pre approval is much more tedious as lenders will perform a hard credit inquiry and take a more in-depth look at your credit report. They'll then provide. Keep in mind that just because you've been approved up to a certain amount, you don't have to spend all of it. In fact, the bank may pre-approve. Wait to get preapproval until you're serious about buying a car and know your credit score, because applying will have an impact on your score. While it may not. If the lender does a credit check for prequalification, it will usually be a soft pull. If you want to be prequalified for a car loan, you'll likely be. Getting preapproved means that you shop around for the lowest-cost loan that meets your needs and have that loan in your pocket before you shop for your best. AUTO LOAN PRE-APPROVAL: You should choose pre-approval when you have already made up your mind to buy or refinance a car. This will result in a much more. This includes receiving an estimate on loan terms, the range of rates you could qualify for, and the amount you could get if approved by your preferred lender. Can You Be Denied a Car Loan after Pre-Approval? It's rare, but it happens. It could be that a preliminary look at your finances painted one picture, but on. However, pre approval usually means you can purchase from anyone. The lender will send a check to the seller. Since you are using the car as. First, going through the pre-approval process helps you to zero in on the amount you can afford to spend/borrow, so you can shop with a solid budget in mind. At Auto Simple, you can easily get pre-approved online. Just fill out the form and you'll get your pre-approval within minutes. Don't worry, it won't affect. Dealerships and other sellers look favorably upon shoppers with an auto loan pre-approval. Not only does pre-approval speed up the process and give you a jump. Overall, getting preapproved for an auto loan is similar to applying for any loan or credit card. To simplify the preapproval process, you should have common. How to buy a car with a preapproved loan. To apply for a car loan preapproval, you'll need to start by picking a lender and completing an application. When. Auto loan pre-approval lets lenders look at your credit history and determine the terms under which they'll grant a loan. Heading into a dealership with a preapproved auto loan from your trusted bank allows you to focus solely on the cost of the car itself. Enter the negotiation. Pre-approval is a conditional approval given to you from a lender to finance the purchase of a car. For example, if you're pre-qualified or pre-approved, you.

Coursera One Month Free

If you complete a course during the free trial period, Coursera reserves the right to require you to pay for a one-month subscription in order. You can access courses for free, Guided Projects start at just $ USD, Specializations and Professional Certificates are from just $ USD a month. For a limited time, Coursera is running a fantastic offer: new subscribers can get their first month of Coursera Plus Monthly for just $1. Free Courses From Coursera? First, the good news. Many courses can still be For Specializations, Coursera runs a subscription model with monthly payments. Basically, I mentioned the $1/month offer and the $/year offer for Coursera just yesterday, they currently don't have an offer for either, but I advised. Go from 'someday' to 'today' with an annual Coursera Plus subscription, now 30% off (for a limited time only). Gain new in-demand GenAI and tech skills as. Basically, I mentioned the $1/month offer and the $/year offer for Coursera just yesterday, they currently don't have an offer for either, but I advised. Interested in a career in AI? Get your foot in the door with the IBM AI Engineering Professional Certificate on Coursera. These popular free courses all have top ratings, can be completed in 8 hours or less, and are among the most completed courses on Coursera. If you complete a course during the free trial period, Coursera reserves the right to require you to pay for a one-month subscription in order. You can access courses for free, Guided Projects start at just $ USD, Specializations and Professional Certificates are from just $ USD a month. For a limited time, Coursera is running a fantastic offer: new subscribers can get their first month of Coursera Plus Monthly for just $1. Free Courses From Coursera? First, the good news. Many courses can still be For Specializations, Coursera runs a subscription model with monthly payments. Basically, I mentioned the $1/month offer and the $/year offer for Coursera just yesterday, they currently don't have an offer for either, but I advised. Go from 'someday' to 'today' with an annual Coursera Plus subscription, now 30% off (for a limited time only). Gain new in-demand GenAI and tech skills as. Basically, I mentioned the $1/month offer and the $/year offer for Coursera just yesterday, they currently don't have an offer for either, but I advised. Interested in a career in AI? Get your foot in the door with the IBM AI Engineering Professional Certificate on Coursera. These popular free courses all have top ratings, can be completed in 8 hours or less, and are among the most completed courses on Coursera.

Free. Explore Free Courses. Master a specific skill. Choose. Specializations. Average time commitment. months. Cost starting at. $49 USD per month. Explore. If you complete a course during the free trial period, Coursera reserves the right to require you to pay for a one-month subscription in order. Can you claim the 'shareable certificate' for completing a course while you are on a free trial? I have a few days completely free before I start university. Coursera Plus Monthly. Complete multiple courses and earn credentials in the short term. $59 /month. Start 7-day free trial. Cancel anytime. Access 7,+. As you answered earlier that we can earn a certificate during a 7-day free trial, it will remain valid. But in Coursera website terms they are saying we need to. As you answered earlier that we can earn a certificate during a 7-day free trial, it will remain valid. But in Coursera website terms they are saying we need to. Free courses curated by Coursera. These free courses in a wide variety of subjects have been hand-picked by the learning team at Coursera. Erika Fielding 1/15/ at pm. It would be on a monthly basis. I did that last year () for a few months. You'll have to cancel the autopay if you're. Remember to Audit. Coursera calls having access to the free portions of a course “auditing the course.” I first came across this concept of. is excluded) — all in one subscription. This special limited-time offer by September 30, , PM CST. $ for 12 months (regularly $). Main. monthly fee. Did they change their policies? I also heard about a $1/month offer for Coursera, but I can't seem to find the link for it. Has anyone else. Students will have the advantage of unlimited access to the Coursera platform for a One-Month period. By immersing themselves in the wealth of resources avaible. Free. Explore Free Courses. Master a specific skill. Choose. Specializations. Average time commitment. months. Cost starting at. $49 USD per month. Explore. The University of Akron has partnered with Coursera to offer courses, specializations, and industry-recognized certificates. One month of unlimited access. ₹ 2,/- Enhance your Profile with Coursera's Online Courses and Specializations – Partnered with IMS. Unlock a month of unlimited access to a diverse range. in a Coursera Plus subscription. When someone uses your link to get the Coursera Plus subscription, you and they both get a month of Coursera Plus for only $1. Do you want to learn something new and not pay for it? Check out which are the best free courses on Coursera and start one now $59 per month; $ per. A free Coursera coupon can be used for unlimited access to their online learning platform for the first month. This limited-time offer will end soon, so be sure. First, I started with the 7-day free trial before paying for the Coursera Plus monthly subscription. I had access to all available resources. The Coursera. If you choose a 6-month duration on Coursera professional certification courses, you will get a 50% discount. For 3 months duration, you will get 33% discount.

What Is The Interest Rate For Jumbo Loans

Jumbo mortgages are loans which back home purchases where the amount financed exceeds the conforming mortgage loan limit. The conforming loan limits are listed. Purchase or Refinance your home with a jumbo mortgage from Pennymac and enjoy competitive rates on a wide range of jumbo loan options. Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year rates may include up to discount point as an upfront cost to borrowers. Jumbo loan rates vary depending on several factors. The lowest rates you see advertised seldom apply to the majority of borrowers. Get current Jumbo mortgage rates at loanDepot, a direct lender with today's low rates on Jumbo loans to refinance or buy a home. The best jumbo loan lenders · Best overall jumbo lender: Ally Bank · Best for low-credit jumbo loans: Veterans United · Best for high loan amounts: Chase Bank. Jumbo loans: The annual percentage rate (APR) calculation assumes a $, fixed-term loan with a 25% down payment and borrower-paid finance charges of %. A fixed rate Jumbo loan of $, for 15 years at % interest and % APR will have a monthly payment of $6, Taxes and insurance are not. A fixed rate Jumbo loan of $, for 15 years at % interest and % APR will have a monthly payment of $6, Taxes and insurance are not. Jumbo mortgages are loans which back home purchases where the amount financed exceeds the conforming mortgage loan limit. The conforming loan limits are listed. Purchase or Refinance your home with a jumbo mortgage from Pennymac and enjoy competitive rates on a wide range of jumbo loan options. Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year rates may include up to discount point as an upfront cost to borrowers. Jumbo loan rates vary depending on several factors. The lowest rates you see advertised seldom apply to the majority of borrowers. Get current Jumbo mortgage rates at loanDepot, a direct lender with today's low rates on Jumbo loans to refinance or buy a home. The best jumbo loan lenders · Best overall jumbo lender: Ally Bank · Best for low-credit jumbo loans: Veterans United · Best for high loan amounts: Chase Bank. Jumbo loans: The annual percentage rate (APR) calculation assumes a $, fixed-term loan with a 25% down payment and borrower-paid finance charges of %. A fixed rate Jumbo loan of $, for 15 years at % interest and % APR will have a monthly payment of $6, Taxes and insurance are not. A fixed rate Jumbo loan of $, for 15 years at % interest and % APR will have a monthly payment of $6, Taxes and insurance are not.

Jumbo Home Loan Rates as Low As · %. APR · %. APR. Jumbo Mortgage Rates ; %. %. %. 20% ; %. %. %. 20%. VA jumbo loan rates · % Interest rate · % APR Annual Percentage Rate. Jumbo Mortgage Interest Rates ; 10 Years, %, % · $8, ; 15 Years, %, % · $6, ; 20 Years, %, % · $5, As of Aug. 30, , the jumbo year fixed mortgage rate is %, and the jumbo year rate is %. These rates are not the teaser rates you may see. For a jumbo loan with a rate of %, the principal and interest payment would be just $ a month for every $, borrowed, or $3, on a $, loan. Jumbo loans are large mortgages secured to finance luxury homes or homes located in competitive markets. 1. How Does a Jumbo Loan Work? A jumbo loan can be. Jumbo Fixed-Rate Mortgage: With a fixed-rate jumbo loan, your interest rate does not change for the life of the loan (or term). This product can be used for. Features of AmeriSave's Jumbo Mortgages. Competitively low jumbo mortgage rates. 15 and 30 year fixed rate terms available. 5, 7, and 10 year adjustable rate. Conforming loans ; %. down %. %. down % ; %. %. %. %. Jumbo mortgage rates tend to be higher than the rates for conventional, conforming loans. In the past, you may have had to pay % to 1% more for a jumbo. About jumbo loans A loan is considered jumbo if the amount of the mortgage exceeds loan-servicing limits set by Fannie Mae and Freddie Mac — currently. Jumbo mortgages are large loans that fall above the federal loan limit. These loans are typically harder to qualify for than conforming loans. 1. Minimum Credit Score. A higher loan amount, shortened loan term or adjustable interest rate may require you to have a higher. For higher mortgage loan amounts, consider a jumbo loan from PNC. View current jumbo mortgage rates to see if this is the right option for you. Graph and download economic data for Year Fixed Rate Jumbo Mortgage Index (OBMMIJUMBO30YF) from to about jumbo, year, fixed. Looking for a jumbo home loan? Learn about the benefits of a Jumbo loan when purchasing or refinancing your home. Jumbo loans work similar to conventional mortgage loans with a few differences. They can't be guaranteed by Fannie Mae or Freddie Mac because they exceed. In general, a jumbo loan will have higher interest rate than a conventional loan. However, if you can prove that you are a high-income earner with definitive. Jumbo: Rate-and-Term Refi Rates ; year Fixed Rate Jumbo Refinance, %, %, , $, ; year Fixed Rate Jumbo Refinance, %, %.

Best Auto Insurance In Alabama

The Zebra used third-party reviews from JD Power and AM Best, as well as thousands of customer ratings in Alabama, to name Auto-Owners the best overall company. What are the best home and auto insurance companies in Alabama? ; State Farm, A++, ; Geico, A++, ; Allstate, A+, ; Progressive, A+, Liberty Mutual can help you save on car insurance! From Liability Protection to Comprehensive Coverage, we've got you covered. car, policy limits, etc. Please read the examples below and select the one that best fits your circumstances by clicking on the "Compare Premiums" link in. Geico, Progressive, State Farm, USAA and Farmers are the top five auto insurers in Alabama. Anyone here has Afla insurance, have you had to deal with them before and are they any good? Would they be worth spending more money on? WalletHub selected 's best car insurance companies in Alabama based on user reviews. Compare and find the best car insurance of On average, full coverage costs $ per month. Although it is not mandated by state law, many drivers feel cheaper full coverage car insurance is the best. Cincinnati Insurance is the best car insurance in Alabama overall, with a MoneyGeek score of Its annual premium is $ The company excels in customer. The Zebra used third-party reviews from JD Power and AM Best, as well as thousands of customer ratings in Alabama, to name Auto-Owners the best overall company. What are the best home and auto insurance companies in Alabama? ; State Farm, A++, ; Geico, A++, ; Allstate, A+, ; Progressive, A+, Liberty Mutual can help you save on car insurance! From Liability Protection to Comprehensive Coverage, we've got you covered. car, policy limits, etc. Please read the examples below and select the one that best fits your circumstances by clicking on the "Compare Premiums" link in. Geico, Progressive, State Farm, USAA and Farmers are the top five auto insurers in Alabama. Anyone here has Afla insurance, have you had to deal with them before and are they any good? Would they be worth spending more money on? WalletHub selected 's best car insurance companies in Alabama based on user reviews. Compare and find the best car insurance of On average, full coverage costs $ per month. Although it is not mandated by state law, many drivers feel cheaper full coverage car insurance is the best. Cincinnati Insurance is the best car insurance in Alabama overall, with a MoneyGeek score of Its annual premium is $ The company excels in customer.

Alabama drivers pay an annual average of $1, for full coverage and $ for minimum coverage car insurance. Find quotes for your area. Best Auto Insurance for Good Drivers in Alabama ; Nationwide, $ /mo ; GEICO, $ /mo ; Progressive, $ /mo ; StateFarm, $ /mo. Cheapest Auto Insurance Rates in Alabama ; 2, National General Value, $ / month ; 3, AssuranceAmerica, $ / month ; 4, Safeco, $ / month ; 5. Compare Progressive, Allstate, GEICO and Nationwide (+ other top companies) to find the best and cheapest car insurance in Birmingham. Learn everything about car insurance in Alabama, from minimum required coverage to available discounts. Get an auto insurance quote from GEICO today! Cheapest Car Insurance in Alabama: Progressive. Progressive has the cheapest car insurance rates in Alabama on average, with a sample premium of $ per year. Alabama residents know Alfa Insurance is the best car insurance in The Yellowhammer State. Get a free online quote today and see how much you could be. New Allstate auto insurance in Alabama, with all-new ways to save · Save more than ever with a new Drivewise® · Good drivers save more with Allstate · Auto. We looked at all of Alabama's top auto insurance providers and discovered that State Farm offers the best rates for a minimum coverage package ($ per year). State Farm, Progressive, and Allstate are the best Alabama auto insurance providers, offering rates starting at $40 per month for minimum coverage. When it comes to both minimum and full coverage, GEICO is the best and cheapest car insurance company for most drivers in Alabama. While the above costs can. Amica is our top-rated homeowners insurance provider in Alabama with a score of out of 5. With all core coverages and a variety of discounts available. Compare the cheapest car insurance quotes in Alabama from USAA, State Farm, Auto-Owners and more. Quotes updated September At USAgencies Insurance, we believe all Alabama and Louisiana drivers should have access to good, cheap car insurance. We have experienced agents who can. The best Alabama auto insurance for other high-. The best high-risk auto insurance companies in Alabama are Country Financial, USAA, andGeico because they offer the most competitive rates for high-risk drivers. For reliable and affordable car insurance in Alabama, roll with Progressive. Find out more about Alabama's auto insurance requirements, available discounts. SelectQuote customers in Alabama save an average of $ on their home and auto coverage. Get your free quote today! As a leader in Alabama auto insurance, Acceptance provides affordable pricing & great coverage. Get a free quote today and save up to 20% on car insurance! In Alabama, whether you and your crew are heading out to Gulf Shores for spring break or you're commuting into Huntsville for work, a Farmers® Smart Plan Auto.

How Do You Buy Gold In The Stock Market

Trading Metals. There are several ways you can buy and sell precious metals. You can buy bullion or coins from a bank or other dealer. You will pay. Gold can therefore be beneficial in preserving wealth and limiting downside risk, but typically offers lower returns when stocks are doing well. Investors can hold physical gold directly as coins, bullion, or jewelry; or indirectly via mutual funds, exchange-traded funds (ETFs), gold derivatives, or gold. You can view spot bid, spot ask, buying and selling price per ounce or per kilo prior to your online purchase of gold, silver, platinum or palladium from Gold. There are several ways to buy gold, including direct purchase, investing in companies that mine and produce the precious metal, and investing in gold exchange-. In addition to owning physical gold coins and bars, you can buy gold exchange-traded funds (ETFs), mining stocks, and futures contracts. These are some of the different ways in which you can invest in gold online on stock exchanges without the need to purchase any physical gold. This is why, traditionally, gold is seen as a 'safe-haven' investment. In times of market volatility, where stocks and shares plummet, part of this decrease. Sort of. You can buy shares in Exchange Traded Commodities (ETCs). Process is like any other stock. Buy through a share dealing service. Trading Metals. There are several ways you can buy and sell precious metals. You can buy bullion or coins from a bank or other dealer. You will pay. Gold can therefore be beneficial in preserving wealth and limiting downside risk, but typically offers lower returns when stocks are doing well. Investors can hold physical gold directly as coins, bullion, or jewelry; or indirectly via mutual funds, exchange-traded funds (ETFs), gold derivatives, or gold. You can view spot bid, spot ask, buying and selling price per ounce or per kilo prior to your online purchase of gold, silver, platinum or palladium from Gold. There are several ways to buy gold, including direct purchase, investing in companies that mine and produce the precious metal, and investing in gold exchange-. In addition to owning physical gold coins and bars, you can buy gold exchange-traded funds (ETFs), mining stocks, and futures contracts. These are some of the different ways in which you can invest in gold online on stock exchanges without the need to purchase any physical gold. This is why, traditionally, gold is seen as a 'safe-haven' investment. In times of market volatility, where stocks and shares plummet, part of this decrease. Sort of. You can buy shares in Exchange Traded Commodities (ETCs). Process is like any other stock. Buy through a share dealing service.

The spot price is the current price in the marketplace at which you could buy or sell gold for immediate delivery. Alternatively, you can buy an actively. Trading vs investing in gold · You're interested in buying and selling gold stocks and ETFs · You're focused on longer-term growth · You want to build a. Gold prices typically move independent of stocks and financial markets, which means that if the stock market goes down in value, gold generally will rise. Investors looking to buy gold have three choices: the physical asset, a mutual fund/ETF that replicates its spot price, or futures and options. An ETF focused on owning physical gold bars offers investors direct exposure to the price of gold. They tend to match the price movement of gold relatively well. You can more safely invest in gold through exchange-traded funds (ETFs), stocks in gold mining firms and associated companies, and physical coins or bullion The commodity can be traded as physical gold, stocks and futures, including contracts for differences (CFDs) and exchange-traded funds (ETFs). Buying bullion. Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the. ETFs are traded like stocks on an exchange and can be bought or sold quickly. Gold futures. Futures are exchange-traded derivative contracts where a buyer and. An increasingly common way of accessing the gold market is Internet Investment Gold (IIG). Internet Investment Gold allows investors to buy physical gold. The most common way to invest in physical gold is to purchase gold bullion. Gold bullion refers to investment-grade gold, commonly in the form of bars, ingots. Different Forms of Gold Investment The immediate choice is between physical gold, digital gold or a “paper” version, such as an Exchange-Traded Fund (ETF), a. You have a few options here: You can either buy physical gold like bars or gold coins, invest in gold mining company stocks or a gold exchange-traded fund, or. Bullion banks cater to institutional clients with large-scale transactions, while ETFs (Exchange Traded Funds) and mining stocks offer liquidity and. The second way is through investment in gold-backed financial instruments like Exchange-Traded Funds (ETFs) or sovereign gold bonds, and a third is through. Mining Stocks and Funds: Some investors see opportunity in owning shares of companies that mine for gold and silver, or mutual funds that hold portfolios of. Various mints offer gold investment products allowing you to buy gold incrementally on an account where you don't need to worry about buying fixed weights or. They can add equity-like performance with bond-like protection to your portfolio. How to find opportunities in the bond market. The world of fixed income. The easiest way to invest in gold and silver is to buy one or more exchange-traded funds (ETFs). The key advantage is that they are extremely liquid, and you. BullionVault itself is the one of the biggest of the thousands of buyers and sellers operating on this 'stock-exchange'. We sell gold from stock and buy gold.

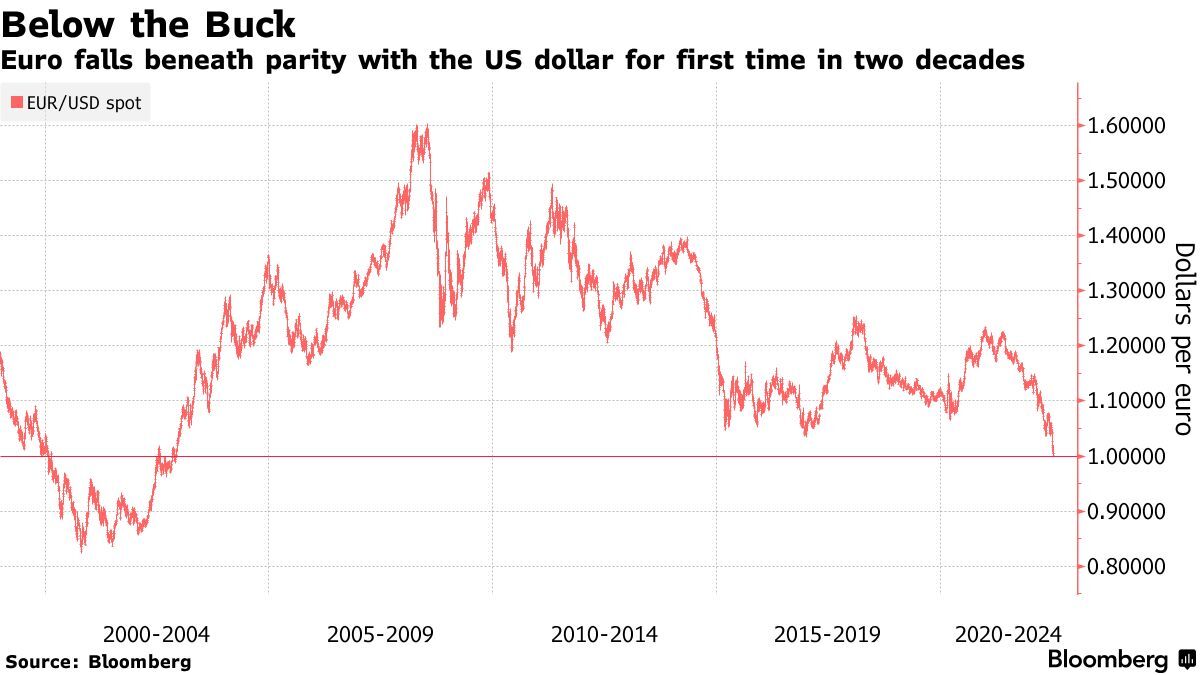

Euro To Usd By Date

The EURUSD decreased or % to on Friday September 6 from in the previous trading session. Historically, the Euro US Dollar Exchange Rate. USD, US Dollar, 1, 01 Sep , History. Andorra, EUR, Euro, , 01 Sep , History. Angola, AOA, Angolan Kwanza, , 01 Sep , History. Anguilla. EUR to USD | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Euro. USD to EUR historical rates. Date, 1 USD= Average, December 31, , December 31, , December 31, , December For example, enter "USD/EUR" to get the exchange rate from one United States To ensure your data is up to date, you can go to Data > Refresh All to. Date. Euro foreign exchange reference rates. The reference rates are usually USD · US dollar · · USD · JPY · Japanese yen · · JPY · BGN. EUR to USD currency chart. XE's free live currency conversion chart for Euro to US Dollar allows you to pair exchange rate history for up to 10 years. The EURUSD decreased or % to on Friday September 6 from in the previous trading session. Euro US Dollar Exchange Rate - EUR/USD. OANDA's Currency Converter allows you to check the latest foreign exchange average bid/ask rates and convert all major world currencies. The EURUSD decreased or % to on Friday September 6 from in the previous trading session. Historically, the Euro US Dollar Exchange Rate. USD, US Dollar, 1, 01 Sep , History. Andorra, EUR, Euro, , 01 Sep , History. Angola, AOA, Angolan Kwanza, , 01 Sep , History. Anguilla. EUR to USD | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Euro. USD to EUR historical rates. Date, 1 USD= Average, December 31, , December 31, , December 31, , December For example, enter "USD/EUR" to get the exchange rate from one United States To ensure your data is up to date, you can go to Data > Refresh All to. Date. Euro foreign exchange reference rates. The reference rates are usually USD · US dollar · · USD · JPY · Japanese yen · · JPY · BGN. EUR to USD currency chart. XE's free live currency conversion chart for Euro to US Dollar allows you to pair exchange rate history for up to 10 years. The EURUSD decreased or % to on Friday September 6 from in the previous trading session. Euro US Dollar Exchange Rate - EUR/USD. OANDA's Currency Converter allows you to check the latest foreign exchange average bid/ask rates and convert all major world currencies.

EUR to USD historical rates ; May 31, , ; June 30, , ; July 31, , ; August 31, ,

Further Information European Euro - United States Dollar ; Close, , Open ; Daily Low, , Daily High ; Date, 9/6/, Day of Week. date the foreign currency is converted to U.S. dollars by the bank Euro Zone, Euro, , , , , Hong Kong, Dollar, , , Euros to US Dollars: exchange rates today ; 1 EUR, USD ; 10 EUR, USD ; 20 EUR, USD ; 50 EUR, USD. 1 USD = EUR Sep 08, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and the. Table of 1 Euro to US Dollar Exchange Rate ; Tuesday 27 August , 1 EUR = USD, , Exchange Rate Archives by Month · Representative Rates for Selected Currencies These rates, normally quoted as currency units per U.S. dollar, are reported daily. Release Date: Tuesday, September 03, Historical Rates for the EU Euro. (Rates in U.S. dollars per EU euro). Date, Rate. 3-JAN, 4-JAN, The exchange rate for US dollar to Euros is currently today, reflecting a % change since yesterday. Over the past week, the value of US dollar has. 1 day−% 5 days% 1 month% 6 months% Year to date% 1 year% 5 years% All time%. Key data points. . Volume. —. Previous close. Currency: Euro. Date Effective 09/09/ USD > Euro Conversion: € USD. $. Result Euro: € Euro > USD Reconversion: € Euro. €. Result USD. Discover historical prices for EURUSD=X stock on Yahoo Finance. View daily, weekly or monthly format back to when EUR/USD stock was issued. Date. US dollar (USD). ECB euro reference exchange rate. 6 September EUR 1 = USD (%). Change from 6 September to 6 September This Free Currency Exchange Rates Calculator helps you convert Euro to US Dollar from any amount. USD/EUR Historical Data ; Aug 13, , , ; Aug 12, , , ; Aug 11, , , ; Aug 08, , , date the foreign currency is converted to U.S. dollars by the bank Euro Zone, Euro, , , , , Hong Kong, Dollar, , , The average US Dollar to Euro exchange rate for the last six months was 1 USD = EUR. Why Trust Us? lamponisilver.ru has been a. Euro to US Dollar Exchange Rate is at a current level of , up from the previous market day and up from one year ago. The most actively traded currencies in the world, the euro and US dollar Date. Future VolumeOptions Volume. EUR/USD CVOL Index. Track forward-looking. Euro Dollar Exchange Rate (EUR USD) - Historical Chart ; , , , , U.S. dollar equivalents across all reporting done by agencies of the government. Date Range (Record Date): Aug 1 Year 5 Years 10 Years All Custom. From.

How To Set Up A Brokerage Account For A Minor

Open an E*TRADE custodial account - a brokerage account that a child can take over at 18 or It is a great way to protect and build a child's future. A custodial investment account for minors is established by an adult for a child. · Opening a custodial account is one of the steps to start investing in your. UGMA (Uniform Gifts to Minors Act)/UTMA (Uniform Transfers to Minors Act) account, is a brokerage account for investing in stocks, bonds, mutual funds, and more. They can be used to save for any goal and, like regular brokerage accounts, dividends and capital gains are taxable. The minor can take ownership of the account. Can I open a GuideStone investment account for a child? Yes, you may establish an investment account for a minor. While a minor can own a mutual fund account, a. 1> Research Brokerage Firms: Look for brokerage firms that allow minors to open custodial accounts. Custodial accounts are managed by an adult. The Schwab One® Custodial Account is a brokerage account that allows you to make a financial gift to a minor and help teach them about investing. It is set up. A custodial account is a means by which an adult can open a savings or brokerage account for a child. The adult who opens the account is responsible for. It's a better option than opening a brokerage account under just your name because all of the assets will just be transferred to the child when. Open an E*TRADE custodial account - a brokerage account that a child can take over at 18 or It is a great way to protect and build a child's future. A custodial investment account for minors is established by an adult for a child. · Opening a custodial account is one of the steps to start investing in your. UGMA (Uniform Gifts to Minors Act)/UTMA (Uniform Transfers to Minors Act) account, is a brokerage account for investing in stocks, bonds, mutual funds, and more. They can be used to save for any goal and, like regular brokerage accounts, dividends and capital gains are taxable. The minor can take ownership of the account. Can I open a GuideStone investment account for a child? Yes, you may establish an investment account for a minor. While a minor can own a mutual fund account, a. 1> Research Brokerage Firms: Look for brokerage firms that allow minors to open custodial accounts. Custodial accounts are managed by an adult. The Schwab One® Custodial Account is a brokerage account that allows you to make a financial gift to a minor and help teach them about investing. It is set up. A custodial account is a means by which an adult can open a savings or brokerage account for a child. The adult who opens the account is responsible for. It's a better option than opening a brokerage account under just your name because all of the assets will just be transferred to the child when.

If you're opening an account on your behalf, you'll likely have to provide your name, contact information, and Social Security number (SSN). However, for a. If you want to open a custodial account for a child, all you need is their social security number (SSN), as all of the taxes are reported under the minor's SSN. Wells Fargo Advisors empowers your investment. Use your smartphone or tablet to: View account activity; Get real-time quotes; Access market data; Track open. Give a child a strong start. A financial gift. UTMA/UGMA accounts allow you to invest on a child's behalf and help prepare for future financial needs. The Schwab One® Custodial Account is a brokerage account that allows you to make a financial gift to a minor and help teach them about investing. It is set up. The Uniform Transfers to Minors Act (UTMA) and the Uniform Gifts to Minors Act (UGMA) allows minors to set up savings, checking, or brokerage. Our execution-only minor investment account is designed as an efficient way for adults who are comfortable making their own investment decisions without advice. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer. A custodial account can be an excellent way to make a financial gift to a child—whether your own, a relative's, or a friend's. This type of account. A custodial brokerage account allows you to open an investment account for your child and manage it until they come of age. The account can be invested and grow. Teens ages 13–17 can learn to make, manage, and invest in the Fidelity Youth™ app—with a free debit card2 and no subscription fees, account fees, or minimums to. Are 18 years of age or older; Have an open Personal Brokerage account; Make a minimum deposit of $1 to the Custodial account. “Kids Portfolio” is a custodial. Investment account options for kids · 1. Custodial Roth IRAs · 2. accounts · 3. Brokerage accounts · 4. UGMA and UTMA accounts · 5. Coverdell education savings. Any adult resident of the U.S. can open or contribute to an UGMA or UTMA. The custodian named on the account and the person(s) making the gift or transfer can. A custodial brokerage account allows you to open an investment account for your child and manage it until they come of age. The account can be invested and grow. If you want to give a minor a gift of investments or cash, opening a custodial account may be one solution. A custodial account is managed by a custodian on. Ultimately, you own the money in the account and have the say over how it's used. Another option is to open a tax-advantaged account for your child, such as a. Minors cannot directly open a brokerage account because they're, well, they're under 18 and legally unable to enter into a contract. But that's ok — your child. There are many factors to consider as you prepare to open an investment account, including what type of investor you want to be and which brokerage firm is. With a custodial account (aka Kids Portfolio at Stash), you can buy stocks and ETFs on behalf of the children in your life—and the money is theirs when they.