lamponisilver.ru Prices

Prices

Citypay

Structural overview. The CityPay SDK for PHP application programming interface ("API") is structured generally in terms of providing a Request object, invoking. Discover fundraising information: Funding Rounds, return on investment (ROI), prices of investors, and funds raised by lamponisilver.ru CityPay for OATH-Adjudicated ECB Violations – Frequently Asked Questions (FAQs) 1. Can I pay by electronic check (e-check)? Yes, you can pay using an e-check. City Pay it Forward is an independent, self-funded charity made up entirely of volunteers. Created by a passionate group of civically-minded business people. CityPay is a comprehensive and robust cloud based HRMS solution that is built on MS Business Central platform. Key features of CityPay solution include -. CityPay Paylink WooCommerce is a plugin that supplements WooCommerce with support for payment processing using CityPay hosted payment forms and Paylin . CityPay Paylink is a comprehensive, low latency, secure and flexible online hosted payment form. It has been built from the ground up to cater for mobile and. CityPay will NEVER send an unsolicited text message asking you to make a payment. If you receive a text message claiming to be from CityPay. CityPay. likes · 1 talking about this. CityPay is a leading payments technology provider, offering complete credit card payment solutions f. Structural overview. The CityPay SDK for PHP application programming interface ("API") is structured generally in terms of providing a Request object, invoking. Discover fundraising information: Funding Rounds, return on investment (ROI), prices of investors, and funds raised by lamponisilver.ru CityPay for OATH-Adjudicated ECB Violations – Frequently Asked Questions (FAQs) 1. Can I pay by electronic check (e-check)? Yes, you can pay using an e-check. City Pay it Forward is an independent, self-funded charity made up entirely of volunteers. Created by a passionate group of civically-minded business people. CityPay is a comprehensive and robust cloud based HRMS solution that is built on MS Business Central platform. Key features of CityPay solution include -. CityPay Paylink WooCommerce is a plugin that supplements WooCommerce with support for payment processing using CityPay hosted payment forms and Paylin . CityPay Paylink is a comprehensive, low latency, secure and flexible online hosted payment form. It has been built from the ground up to cater for mobile and. CityPay will NEVER send an unsolicited text message asking you to make a payment. If you receive a text message claiming to be from CityPay. CityPay. likes · 1 talking about this. CityPay is a leading payments technology provider, offering complete credit card payment solutions f.

Download Citytouch to experience CityPay QR Code payment today and enjoy contactless payment. Google Play Store Button App Store Button. Manual installation. To perform a manual installation of the CityPay Paylink WordPress plugin, login to your WordPress dashboard, select the Plugins menu and. City Pay. Manage Your Library Account · Parking Enforcement · Pay for Business License Renewal (eTRAKit). Categories. All Categories · - Home - Common. CityPay Service Desk. Welcome! You can raise a CityPay Service Desk request from the options provided. CityPay provide secure and dependable cloud-based services. Meeting the needs of all modern-day transaction needs through multiple channels including Internet. lamponisilver.ru (@lamponisilver.ru) on TikTok | Likes. Followers. Crypto payment provider lamponisilver.ru the latest video from lamponisilver.ru (@lamponisilver.ru). City Pay Summary. Payroll. View based on City Employee Payroll (). Payroll information for all Los Angeles City Departments since Data for. If you receive a text message claiming to be from “CityPay,” please delete it. We will never send you an unsolicited text message reminding you to make a. You are here: Home / City Information/ Departments / Human Resources Department / Classification & Compensation / City Pay Plans. lamponisilver.ru is a cryptocurrency payment gateway for any type of business to monitor and control cryptocurrency receiving. CityPay simplifies your financial transactions with seamless top-up, remittance, and payment services. Experience convenience and security in every transaction. likes, 1 comments - nyc on July 2, " Attention #NYC! CityPay will NEVER send you an unsolicited text message reminding you. STOP! It's a SCAM! CityPay does NOT send text messages requesting payments! If you receive a payment request via text, please delete it. Beyond Remittances, Embrace Convenience! Discover the new age of money transfers with CityPay. Why be limited to just remittances when you can have so much. If you receive a text message claiming to be from “CityPay,” please delete it. We will never send you an unsolicited text message reminding you to make a. Install Magento extensions by citypay. Launch your Magento store with any Magento theme for free. Get started now! Discover the future of digital finance with the lamponisilver.ru wallet. Manage your cryptocurrencies, buy or sell, send and receive or swap crypto instantly. lamponisilver.ru | followers on LinkedIn. CityPay is a digital currency payment solution for businesses, allowing them to accept payments in cryptocurrencies. Meet CityPay: the payment gateway platform that allows businesses to accept crypto payments. Today it is our pleasure to unveil the 7th startup (out of

Bankrate High Interest Savings

Best for: Earning a higher interest rate when you lock in your funds for a longer term. Best for: Retirement savings with the ability to raise your CD rate. Bread Savings High-Yield Savings Accounts offer highly competitive rates, interest accrued and compounded daily, no hidden fees and free monthly maintenance. Best High-Yield Savings Account Rates for August Poppy Bank – % APY; Flagstar Bank – % APY; Western Alliance Bank – % APY; Forbright Bank –. Check below for our most current interest rates, APYs and minimums required on our accounts: Checking, Savings, Certificates of Deposit, Individual Retirement. High Yield Savings Account Rates ; Interest Rate%, Annual Percentage Yield (APY)%, Minimum Balance to Open$50,, Minimum to Earn APY$50, ; Interest. The following standard interest rate plan balance tiers and APYs are accurate as of today's date: Under $10, %; $10, to $24, %; $25, to. Its high-yield savings account pays an excellent % APY. There is no monthly fee, no minimum balance requirements and all balance tiers earn the top rate. Personal banking rates · Savings · EverBank Performance℠ Savings · EverBank Performance℠ Money Market · CDs · EverBank Performance℠ CDs · CDARS® CDs · Year Bump. High yield savings accounts are a flexible and easy way to earn interest while saving money. Learn More. How. Best for: Earning a higher interest rate when you lock in your funds for a longer term. Best for: Retirement savings with the ability to raise your CD rate. Bread Savings High-Yield Savings Accounts offer highly competitive rates, interest accrued and compounded daily, no hidden fees and free monthly maintenance. Best High-Yield Savings Account Rates for August Poppy Bank – % APY; Flagstar Bank – % APY; Western Alliance Bank – % APY; Forbright Bank –. Check below for our most current interest rates, APYs and minimums required on our accounts: Checking, Savings, Certificates of Deposit, Individual Retirement. High Yield Savings Account Rates ; Interest Rate%, Annual Percentage Yield (APY)%, Minimum Balance to Open$50,, Minimum to Earn APY$50, ; Interest. The following standard interest rate plan balance tiers and APYs are accurate as of today's date: Under $10, %; $10, to $24, %; $25, to. Its high-yield savings account pays an excellent % APY. There is no monthly fee, no minimum balance requirements and all balance tiers earn the top rate. Personal banking rates · Savings · EverBank Performance℠ Savings · EverBank Performance℠ Money Market · CDs · EverBank Performance℠ CDs · CDARS® CDs · Year Bump. High yield savings accounts are a flexible and easy way to earn interest while saving money. Learn More. How.

Maximize your savings with a Cornerstone Money Market Account. Earn higher interest rates and access your funds at any time. Grow your savings with our high-interest savings account. Earn % APY 1 guaranteed for the first 5 months. Maximize your money with our high-yield online savings account that offers great interest rates, no fees and no required balance or minimum deposit. Learn how opening a Higher Interest Savings Account with a Huntington checking account can help you earn even more interest on this high interest/yield. Grow your savings with BMO's high-yield, online-only CDs. No minimum balance, $0 minimum opening deposit, 6 available fixed terms, and interest paid monthly. Seeking a high-interest bank account? Learn more about the different HSBC accounts, their banking deposit rates including the minimum balance to open an. View interest rates, annual percentage yields and minimums to open an account on savings and money market accounts, and CDs. Member FDIC. Essentially, a high-yield savings account is a savings account with a higher interest rate than traditional savings accounts. In savings accounts, interest is. Receive the service you deserve while you earn % Annual Percentage Yield (APY). Saving more with Bask means earning more rewards — without monthly. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. SoFi members with direct deposit are eligible for other SoFi Plus. You should compare savings account yields by looking at annual percentage yields (APYs). Comparing APYs means you don't have to worry about compounding. With an online high-yield savings account, you can reach your savings goals faster by earning interest at a higher rate than traditional savings accounts. % APY Annual Percentage Yield Our High-Yield Online Savings Account is the smart choice for anyone looking to grow their savings and achieve financial. A high-interest Savings Account can make it easier to achieve financial goals, such as saving for retirement, buying a house, or going on a family vacation. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! With tiered rates, you earn more interest with a higher balance. And when you link an eligible account, you'll earn a relationship bump rate Like most savings accounts, interest-bearing checking accounts earn a yield that's variable, meaning the bank can increase or decrease the rate at its. Offering one of the highest online savings rates around, we also provide full FDIC insurance coverage directly Interest rate is variable and subject. APY Month Term Certificate Of Deposit; % APY High Yield Money Market Account. Interest Rate, APY, Details. MTBS Money Market, $1,, $1,

How Much Money Should You Put In Your Savings Account

There is no limit on how much money you can keep in a savings account. But the money should be legally obtained and you should have proof of it. We tell all of our family to put their money in savings here! Sue M. January How much money should I have in my savings account? Most financial. Savings account: 2 to 4 months of expenses. After allocating one to two months of your expenses into a checking account, Anderson says that the two to four. The general guideline is to accumulate three to six months' worth of household expenses. Consider putting it in a high yield savings or money market account. Estimate how much you need invested to live off interest with the formula: Annual income / Annual interest rate = Savings goal; Different investment strategies. There is no limit on how much money you can keep in a savings account. · Rather you can invest your money to get higher returns than saving bank. For example, if your total expenses are $K a month, you should have at least $K in a high yield savings account. More is better if. Consumer finance experts recommend that people maintain about five to six months of cash in their savings account to cover medical emergencies, mortgage or. A general suggestion is to set aside 10% of your take-home pay for savings. But this may not always be feasible and any amount of money you regularly put away. There is no limit on how much money you can keep in a savings account. But the money should be legally obtained and you should have proof of it. We tell all of our family to put their money in savings here! Sue M. January How much money should I have in my savings account? Most financial. Savings account: 2 to 4 months of expenses. After allocating one to two months of your expenses into a checking account, Anderson says that the two to four. The general guideline is to accumulate three to six months' worth of household expenses. Consider putting it in a high yield savings or money market account. Estimate how much you need invested to live off interest with the formula: Annual income / Annual interest rate = Savings goal; Different investment strategies. There is no limit on how much money you can keep in a savings account. · Rather you can invest your money to get higher returns than saving bank. For example, if your total expenses are $K a month, you should have at least $K in a high yield savings account. More is better if. Consumer finance experts recommend that people maintain about five to six months of cash in their savings account to cover medical emergencies, mortgage or. A general suggestion is to set aside 10% of your take-home pay for savings. But this may not always be feasible and any amount of money you regularly put away.

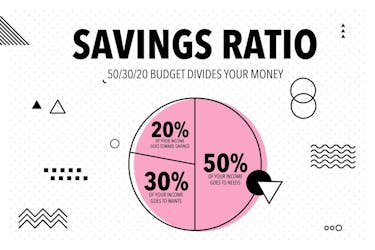

How much you should have in your savings account depends on your age but at minimum you should have an emergency fund with enough money to cover your. Based on our estimates, saving 15% each year from age 25 to 67 should get you there. If you are lucky enough to have a pension, your target savings rate may be. much and how often you're able to put money away. Create a system for money is moved automatically from your checking account to your savings account. There are many savings and investment accounts suitable for short- and long-term goals. And you don't have to pick just one. Look carefully at all the options. At least 20% of your income should go towards savings. Meanwhile, another 50% (maximum) should go toward necessities, while 30% goes toward discretionary items. Businesses should aim to save 10% of their monthly profits and collect months' expense costs. Business savings accounts allow you to grow your savings with. Someone between the ages of 61 and 64 should have times their current salary saved for retirement. Source: Chief Investment Office and Bank of America. So if you're making $50,, that's the amount of money you should have saved by However, you may be paying off student loans or trying to save for a new. The general rule of thumb is that you should save 20% of your salary for retirement, emergencies, and long-term goals. By age 21, assuming you have worked full. Using a savings calculator allows you to see how fast your money will grow when put in an interest-earning account. How much you should save depends greatly. A simple rule of thumb is to save 20% of your income. For example, if you earn $75, annually, save about $15, per year or $1, per month. Don't be. There is no limit on how much money you can keep in a savings account. But the money should be legally obtained and you should have proof of it. While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least. The general rule of thumb is to try to have one or two months' of living expenses in it at all times. Some experts recommend adding 30 percent to this number. The amount you should save every month depends on your financial goals, income, and expenses. Most people start by building an emergency fund of at least three. Once you've paid off debt and have three to six months of savings in the bank, start putting your money to work for you. When you save or invest money, you'll. The 50/30/20 budget, for instance, is a strategy that suggests allocating 50% of your income to necessities, 30% to personal spending, and 20% to savings. Ways. Use savings buckets. Try refining your savings goals by maintaining separate accounts for different needs. For instance, you might open one account for short-. It's our simple guideline for saving and spending: Aim to allocate no more than 50% of take-home pay to essential expenses, save 15% of pretax income for. A savings account is a bank or credit union account designed to keep your money safe while providing interest. Learn how savings accounts work.

High Risk Commercial Auto Insurance Companies

The General specializes in providing car insurance for high-risk drivers. Even if you need an SR or have a DUI on your driving record, you may qualify. Intact Insurance offers a unique coverage solution designed for complex and emerging commercial auto exposures and opportunities. auto risk expertise. Learn about high-risk commercial insurance options, factors contributing to high-risk status & how companies can get the lowest premiums for high-risk. With Mercury Insurance, you can customize a commercial auto insurance policy to fit your company's specific needs. Commercial vehicles typically carry more risk. Find the lowest rates on small business insurance. Compare offers from Canada's leading providers. Just like that. Whether you own a single company car or an entire fleet, commercial auto coverage is a must if your business relies on vehicles to get things done. get a. Reliance Partners is a leading expert in truck insurance solutions for the high risk market. We have access to a number of very exclusive insurance markets. higher risk. External variables like industry regulations, market trends, and insurance industry dynamics can also influence premiums. Understanding these. At Regal Insurance, we help businesses determine if they have a high-risk business and thus are considered a higher insurance risk. The General specializes in providing car insurance for high-risk drivers. Even if you need an SR or have a DUI on your driving record, you may qualify. Intact Insurance offers a unique coverage solution designed for complex and emerging commercial auto exposures and opportunities. auto risk expertise. Learn about high-risk commercial insurance options, factors contributing to high-risk status & how companies can get the lowest premiums for high-risk. With Mercury Insurance, you can customize a commercial auto insurance policy to fit your company's specific needs. Commercial vehicles typically carry more risk. Find the lowest rates on small business insurance. Compare offers from Canada's leading providers. Just like that. Whether you own a single company car or an entire fleet, commercial auto coverage is a must if your business relies on vehicles to get things done. get a. Reliance Partners is a leading expert in truck insurance solutions for the high risk market. We have access to a number of very exclusive insurance markets. higher risk. External variables like industry regulations, market trends, and insurance industry dynamics can also influence premiums. Understanding these. At Regal Insurance, we help businesses determine if they have a high-risk business and thus are considered a higher insurance risk.

Commercial auto insurance is a $ billion dollar industry - and it's not done growing. From wheelers, to waste haulers, tankers, delivery vehicles and. For each vehicle shown, there are a significant number of insurers that do not wish to write the particular vehicle, due to unfavorable loss experience, high. Car Insurance · Telematics / Usage Based Insurance · High Risk Auto Insurance · Young Driver Auto Insurance · Home Insurance · Tenant Insurance · Life Insurance. Why does commercial car insurance cost more than personal coverage? a commercial van on driving on a city street. Driving for work is associated with increased. We offer coverage for commercial long-haul trucking, limousines, taxis and medical transport vehicles. Contact us for customized auto insurance today! Transporting hazardous materials, for example, would typically result in higher insurance costs due to the increased risk. Driver History. Insurance providers. Commercial Car Insurance · Useful coverage options and operational support · Highly specialized coverage for contractors · Coverage developed specifically for food. Solutions for complex risks. Any company with commercial vehicles deals with accidents – and with each come the time and money spent on repairs. high level of risk that goes with operating business vehicles. This coverage Business vehicles should always be insured to protect the company against claims. Risks with high loss frequency; Ready mix concrete operations; Hot shot operations or expeditors. Territories for Coverage. RLI offers coverage throughout the. Desperately need help finding commercial insurance for an auto repair shop in Pennsylvania. We are being dropped by our current insurance. High risk auto insurance depends on both cars and drivers. Learn how you can lower your car insurance premium with State Farm. Get a quote today. High-risk commercial truck insurance is a type of insurance specifically designed for trucking companies or owner-operators who are considered to have a higher. High risk auto insurance depends on both cars and drivers. Learn how you can lower your car insurance premium with State Farm. Get a quote today. Whether you own a single company car or an entire fleet, commercial auto coverage is a must if your business relies on vehicles to get things done. get a. These policyholders are labeled high risk because they're considered more likely to cause an accident. Not every company offers this non-standard type of. Best Commercial Auto Insurance of ; Best Overall: Progressive ; Best for Large Fleets: Sentry ; Best for Construction and Contractors: Farmers ; Best for Ride-. A typical commercial auto policy may include: Auto liability, which protects you and your company by paying for bodily injury or property damages. Have a bad driving record? Here are the best car insurance companies for high-risk drivers ; Best overall. State Farm Auto Insurance · Read our State Farm auto. This includes companies that own or lease cars, trucks, vans, or other vehicles for the purpose of transporting goods, equipment, or people. Common professions.

What Is The Best Bank With No Fees

Compare Chase checking accounts and select the one that best Secure Banking SM. A simple checking account with no overdraft fees. Savings Account. ZERO Fee on common Savings Account services. ZERO Fee. Close. With IDFC FIRST Bank, you pay zero charges on all commonly used Savings Account. Simple banking with an easy-to-use experience. Open now - Advantage SafeBalance Banking. $ or $0 Monthly maintenance fee. Get day-to-day banking with no monthly maintenance fees and no minimum balance requirements. Bank foreign ATM fees and fees at non-proprietary ATMs. More perks and better rates when you bank with us. Woman accessing First Checking accounts typically have fewer (or no) fees when you use money in. One extra Business Advantage Relationship Banking account and one Business Advantage Savings account can be included for no monthly fee · No fees for incoming. Just shop around banks in your area and you'll find one with no fees. Sometimes there is a criteria for qualifying for a no fee account (like. Open an Alliant High-Rate Checking account with no monthly fees, ATM rebates and easy online banking. Apply now! No monthly fees and no minimum balance fees · No overdraft fees · 50,+ fee-free¹ ATMs at stores like Walgreens®, 7-Eleven®, CVS Pharmacy®, Circle K & more. Compare Chase checking accounts and select the one that best Secure Banking SM. A simple checking account with no overdraft fees. Savings Account. ZERO Fee on common Savings Account services. ZERO Fee. Close. With IDFC FIRST Bank, you pay zero charges on all commonly used Savings Account. Simple banking with an easy-to-use experience. Open now - Advantage SafeBalance Banking. $ or $0 Monthly maintenance fee. Get day-to-day banking with no monthly maintenance fees and no minimum balance requirements. Bank foreign ATM fees and fees at non-proprietary ATMs. More perks and better rates when you bank with us. Woman accessing First Checking accounts typically have fewer (or no) fees when you use money in. One extra Business Advantage Relationship Banking account and one Business Advantage Savings account can be included for no monthly fee · No fees for incoming. Just shop around banks in your area and you'll find one with no fees. Sometimes there is a criteria for qualifying for a no fee account (like. Open an Alliant High-Rate Checking account with no monthly fees, ATM rebates and easy online banking. Apply now! No monthly fees and no minimum balance fees · No overdraft fees · 50,+ fee-free¹ ATMs at stores like Walgreens®, 7-Eleven®, CVS Pharmacy®, Circle K & more.

3. First Tech Federal Credit Union. First Tech Rewards Checking® is a solid option for high-interest checking. The account has no minimum balance requirements. Benefits You Can Bank On · No hidden fees, no minimum balance · A contactless debit card · Fraud protection. Axos' Essential Checking account comes with no monthly, annual or overdraft fees. An Axos representative told TPH all its checking accounts require a $ charge no more than three overdraft fees per business day. Overdraft fees are not applicable to Clear Access Banking accounts. The payment of transactions. Our choice for the best zero-balance checking account is Ally Bank. The Ally Bank Spending Account does not charge monthly maintenance or overdraft fees, and. Open an Alliant High-Rate Checking account with no monthly fees, ATM rebates and easy online banking. Apply now! Perfect if you want basic checking with no monthly service fee and an electronic statement. No minimum balance. No monthly service fee with enrollment in. Chime was launched with a mobile-first banking approach, and its mobile banking and zero maintenance fees make it a great option for students, allowing you to. With no monthly service fees or overdraft fees, you'll have more money to invest. Travel with confidence. No foreign transaction fees. Minimum deposit: $0 · Interest: None, cash back only · Fees: · Monthly Fees: $0 monthly fee · Overdraft Fee: $0—no charge for overdrafts or insufficient funds. · ATM. One extra Business Advantage Relationship Banking account and one Business Advantage Savings account can be included for no monthly fee · No fees for incoming. Benefits You Can Bank On · No hidden fees, no minimum balance · A contactless debit card · Fraud protection. Savings accounts that always put your best interest first Direct deposits available up to two days earlier and no fees when you overdraw your personal. High checking APY · One of the highest APY for CDs and savings account · No monthly fees, overdraft, or NSF fees · Comes with a debit card · Large fee-free ATM. Compare Chase checking accounts and select the one that best Secure Banking SM. A simple checking account with no overdraft fees. MyWay Banking from M&T Bank®. Great for Starting Out. No overdraft fees. MyWay Banking from M&T Bank®. Great for Starting Out. No overdraft fees. Student bank accounts come without fees common in traditional checking accounts, such as monthly or overdraft fees. When graduation comes, these accounts can be. We review the best checking accounts offering no-fee ATM use based on account features, interest rates, potential fees, and minimum balances. The Discover® Cashback Debit account is a great choice for free banking. There are no monthly fees, and you pay $0 for checks, stop payment orders, and.

How Long Can You Collect Social Security

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than. However, if your ex-spouse is deceased and you are currently unmarried, you may collect benefits as early as age 60 as a surviving divorced spouse. If he or she. will live until at least age 90, and 1 out of 7 will live until at least age Social Security benefits, which last as long as you live, provide valuable. How long can you receive SSDI? The benefit period lasts until age 65 (unless your disability resolves itself earlier), at which point you should qualify for. Part-time work can still count towards the 5-year rule as long as you earn enough each year to receive the required work credits. Does the 5-year rule apply. As you near retirement, the decisions you make could have a significant impact on the amount of money you receive, and some of these choices are irrevocable. You're 62 or older; You've worked and paid Social Security taxes for 10 years or more. We keep track of how many years you've paid Social Security. Your eventual benefits will increase every year you delay benefits past your full retirement age until you reach Connect with your advisor to learn more. You can receive benefits even if you still work. Waiting beyond age 70 will not increase your benefits. You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than. However, if your ex-spouse is deceased and you are currently unmarried, you may collect benefits as early as age 60 as a surviving divorced spouse. If he or she. will live until at least age 90, and 1 out of 7 will live until at least age Social Security benefits, which last as long as you live, provide valuable. How long can you receive SSDI? The benefit period lasts until age 65 (unless your disability resolves itself earlier), at which point you should qualify for. Part-time work can still count towards the 5-year rule as long as you earn enough each year to receive the required work credits. Does the 5-year rule apply. As you near retirement, the decisions you make could have a significant impact on the amount of money you receive, and some of these choices are irrevocable. You're 62 or older; You've worked and paid Social Security taxes for 10 years or more. We keep track of how many years you've paid Social Security. Your eventual benefits will increase every year you delay benefits past your full retirement age until you reach Connect with your advisor to learn more. You can receive benefits even if you still work. Waiting beyond age 70 will not increase your benefits.

You can claim Social Security benefits at 62, below full retirement age, and still work. · Benefits are temporarily reduced for those who haven't reached their. If you start receiving benefits at age 66 you get percent of your monthly benefit. If you delay receiving retirement benefits until after your full. The SSA website provides estimates for how much you'll collect if you start receiving benefits at age 62, your full retirement age (FRA) (between 66 and 67). You can get Social Security retirement benefits and work at the same time before your full retirement age. However your benefits will be reduced. You may be eligible to collect Social Security as early as 62, but waiting until age 70 yields greater benefits for most people. Here's help on how to. If you have ALS (also called Lou Gehrig's disease) you'll get Medicare automatically as soon as you start getting disability benefits. In both cases, follow. What Age Are You When Social Security Disability Stops? Social Security Disability can stay active for as long as you're disabled. If you receive benefits. Early retirement benefits will continue to be available at age 62, but they will be reduced more. When the full-benefit age reaches 67, benefits taken at age Social Security provides a source of income when you retire or if you cannot work due to a disability. Learn about the types of Social Security benefits. Your Social Security benefits could be reduced if you receive federal, state Waiting to claim as long as you can could still make sense for you if. Because you are age 70 or older, you should apply for your Social Security benefits. You can receive benefits even if you still work. Waiting beyond age You can receive your Social Security retirement benefits as early as age 62, but the benefit amount you receive will be less than your full retirement. Social Security is no exception. The basic FRA depends on your birth year. For anyone born in or later, full retirement age is For those born in People who have worked long enough may also be able to receive Social Security Disability Insurance benefits as well as Supplemental Security Income (SSI). If you were born between and , your full retirement age increases gradually until it reaches age 67 for those born in or later. The below chart. The age you stop working can affect the amount of your Social Security retirement benefits. We base your retirement benefit on your highest 35 years of. The earliest age you can collect Social Security benefits is If you they were long-time, low-wage earners. For example, the low-income earner. It depends on the year you were born and how long until you reach full retirement age, abbreviated as FRA. That's the age at which you would collect You will soon have choices to make. Once you turn 62, you will have important decisions to make about work and your Social Security retirement benefits. Once you reach full retirement age, you can make any amount of money and still receive your full Social Security retirement benefit. Example. Henry is.

Uber Eats Driver Account

Can I drive for Lyft or Uber under someone else's account? Yes you can. People asking this question are felons. Up to 10% off eligible orders with Uber Eats; Member pricing and top-rated drivers on Uber. How to sign up for an Uber membership. If you're. If you can't sign in, try these options: 1. Verify you're using the correct login details. Double check the email/phone number and password match the. 6% Uber Cash back and top-rated drivers on eligible rides. Cancel without If you have an Uber account, you may opt-out of the “sale” or “sharing” of. To get started, download the Uber Driver app. Once you have created an account and uploaded the required documents, it will take up to 72 hours for these to be. You can create several accounts and use them as you choose (for example, when traveling). Each account saves its own set of payment methods, promo codes and. They sell accounts arount $, rent them like $ a month., There is no cost and actually you don't have to hacker. Just buy a fake ssn and resell it. 3x in a row my food was beyond late and cold. The restaurant does their jobs on having the food ready but Uber eats has barely ANY drivers to pick up and drop. It's your hustle. Our flexibility. Your independence. Our security. Your business. Our support. Here's why you should drive, deliver, and earn money with Uber. Can I drive for Lyft or Uber under someone else's account? Yes you can. People asking this question are felons. Up to 10% off eligible orders with Uber Eats; Member pricing and top-rated drivers on Uber. How to sign up for an Uber membership. If you're. If you can't sign in, try these options: 1. Verify you're using the correct login details. Double check the email/phone number and password match the. 6% Uber Cash back and top-rated drivers on eligible rides. Cancel without If you have an Uber account, you may opt-out of the “sale” or “sharing” of. To get started, download the Uber Driver app. Once you have created an account and uploaded the required documents, it will take up to 72 hours for these to be. You can create several accounts and use them as you choose (for example, when traveling). Each account saves its own set of payment methods, promo codes and. They sell accounts arount $, rent them like $ a month., There is no cost and actually you don't have to hacker. Just buy a fake ssn and resell it. 3x in a row my food was beyond late and cold. The restaurant does their jobs on having the food ready but Uber eats has barely ANY drivers to pick up and drop. It's your hustle. Our flexibility. Your independence. Our security. Your business. Our support. Here's why you should drive, deliver, and earn money with Uber.

Im Looking for Uber driver account or Uber eats in chicago. If any one interested to rent their accounts please DM me · GuranteesolutionTech Austin · 1. Uber will use your background check to assess suitability in meeting the requirements to register an Uber Driver app account. Background checks can take up. I'm an Uber driver, someone filed a claim against me stating I refused to pick them up because they had a service animal. · The Lawyer can help you determine if. account. Create Avis Profile. NOT an Uber Driver? Only approved Uber drivers can rent a car in this program. Please make sure you are an approved driver. Delivering using the Uber Eats app. Here's some information about how the app can help make deliveries successful. Looking for driving info? Switch to driver. By opting in, I agree to receive calls or SMS messages for Uber Eats merchant account updates, including by auto-dialer and pre-recorded voice, from Uber and. Uber Health is dedicated to helping improve health outcomes by helping enable better access to care and services. It is an exploratory testing project, and an Uber Eats account is required to participate in the runs. We accept applications from candidates who are already. Not an eligible Uber driver? Click below to enroll today and start earning Already have an Uber account? Drivers can now book their rental directly. To get started, though, all potential drivers should make sure they qualify to drive and set up a driver account. Steps. Part 1. A Driver may not share their account with anyone. A Driver's name, face, and overall profile should always match. If they do not, report. Explore support and customer service resources to find solutions to issues related to driving and delivering with Uber. Go to Account, then Settings · Select Privacy · Scroll down and tap Account Deletion · Follow the remaining steps in the app to complete the process. Find out how to set up your bank account and track your next transfer. Looking for driving info? Switch to driver · Get started · Already have an account? Sign. By opting in, I agree to receive calls or SMS messages for Uber Eats merchant account The Uber platform can connect you with independent drivers, bike and. Find the best restaurants that deliver. Get contactless delivery for restaurant takeout, groceries, and more! Order food online or in the Uber Eats app and. Download the Uber Eats app and order restaurant delivery or pickup from your favorite places to eat and drink Open the app and sign in or create an account. If you request to delete your account, all of your Uber profiles, including your rider and Uber Eats profiles, will be permanently deleted after it's no longer. The most common reasons a driver or delivery person might lose access to their account are an expired document or an issue with their background check. Drivers. As an existing Delivery Person with Uber Eats you will need to submit a request to switch your account so that you can accept trip requests and drive with the.

How Much Does Refinancing A Car Save

The difference in monthly payment amount represents an average reduction of $43 per month. This reduction reflects the terms of Auto Refi Loans actually. Our refinance car loan calculator will help determine how much you can save on your monthly payments, interest, or both. Calculate your potential auto refinance savings. Use this auto refinance calculator to compare your current loan with a refinance loan. If you decide to refinance, you may be able to lower your monthly payment or reduce your APR. If you choose a loan term that is longer than the term remaining. Lower interest rate: One of the best reasons to refinance a car loan is to lower your interest rate. A lower interest rate can help you save money on the cost. Use our auto refinance calculator to find out how much you can save on your monthly car payment. See your options inside! Use this helpful auto refinance calculator to determine if you can save on your monthly payments by refinancing your auto loan with Navy Federal. Refinancing your car could potentially save you money by lowering your monthly car payment or decreasing the amount of interest you pay. You can then put that. iLending customers save $/month on average and can lower their interest rate when they refinance their car loan. View a real life savings example. The difference in monthly payment amount represents an average reduction of $43 per month. This reduction reflects the terms of Auto Refi Loans actually. Our refinance car loan calculator will help determine how much you can save on your monthly payments, interest, or both. Calculate your potential auto refinance savings. Use this auto refinance calculator to compare your current loan with a refinance loan. If you decide to refinance, you may be able to lower your monthly payment or reduce your APR. If you choose a loan term that is longer than the term remaining. Lower interest rate: One of the best reasons to refinance a car loan is to lower your interest rate. A lower interest rate can help you save money on the cost. Use our auto refinance calculator to find out how much you can save on your monthly car payment. See your options inside! Use this helpful auto refinance calculator to determine if you can save on your monthly payments by refinancing your auto loan with Navy Federal. Refinancing your car could potentially save you money by lowering your monthly car payment or decreasing the amount of interest you pay. You can then put that. iLending customers save $/month on average and can lower their interest rate when they refinance their car loan. View a real life savings example.

The true cost of auto loan refinancing can include transaction fees and other potential charges. While you may save money in the long run if you refinance at a. Refinancing a car loan may save you money overall and help you pay off your loan faster. It's generally best to refinance your car loan when market rates are. Refinancing your car is easier than you might think. Pre-qualify in minutes. Tell us about yourself and your vehicle to see what you could save. Chances are, you can. We're always looking for ways to save you money and help you grow your finances, so apply now, and evaluate better auto payment options. Members save over $2, on average by refinancing their auto loan. Checking your rate won't impact your credit score. Save Money with Auto Loan Refinancing · What is Refinancing? · Cash-out auto loan refinancing: How does it work? · Auto Refinance Benefits · Our great rates help. Refinancing can be used to reduce a buyer's monthly payments, making the loan more manageable on a month to month basis. For example, if a buyer refinances. There's no set amount of time you need to wait before you refinance your auto loan from another lender with us. Are there any fees associated with refinancing a. car is or how many miles it has. You may still qualify. Flexible payment options. Set up automatic payments and save % on your lamponisilver.ru note2 You can pay. Enter the specifics about your current loan and determine how much interest refinancing can save you. In addition, it will calculate the number of months to. If so, there's a better chance you can benefit from refinancing your car loan to a lower interest rate. Keep in mind that lenders consider criteria beyond. If you were to refinance (while keeping a month term) you would save $2, in overall interest. Your monthly payment would also go down from $ to $ If you qualify for refinancing, you could save money each month by lowering your auto loan payment. If you don't qualify for refinancing, you may still be able. Refinancing your auto loan can help you reduce your monthly payments, in addition to reducing your interest rate. Our refinance customers tend to save over. How much you can save also depends on the interest rate on your current loan. The worse the terms of your current loan, the more you can potentially save by. Our auto loan refinance calculator will show you whether refinancing can save you money. Apply early so you know how much car you can afford. Your You might hear that refinancing won't save you much money — and in some cases, that may be true. Each situation is unique. But if you can get a significantly. Use the auto loan refinance calculator to estimate how much money you can save by refinancing your auto loan. Calculate your savings. If you can do it without any cost, absolutely. A borrower that refinances a $, loan for a % rate reduction saves $ per year. If you. Refinancing your car loan can lower your monthly payment and interest rate. Learn how you can save money by refinancing your car loan.

Can You Search Instagram By Email

Then, you can use this data to find out more about the person via an X-Ray Contact search. In the Search panel, select the “Email” tab and look for more. So you look to see if you can automate it somehow. You check your app's built-in integrations and search for any Zapier integrations. No luck. But you notice. To recover your Facebook account or change the password, try this: Enter the email you used to sign up for Facebook or your phone number to search for your. Import your email To search for a specific person on LinkedIn mobile web, type their name into the search bar at the top of the LinkedIn homepage. You can. 1. You can search for people on Instagram by email by using the search bar on the website. · 2. You can find people on Instagram by email by. Adding a link to your Stories is easy. When creating the Story, click on the “sticker” option, and search for “link.” This will give you the option to add a. You can view official Instagram emails sent within the last 14 days from your Settings. Type the username or real name of the person you want to follow (if you know their username, it'll make your search much quicker). The app will recommend. What are the easiest methods to find someone's Instagram email? Then, you can use this data to find out more about the person via an X-Ray Contact search. In the Search panel, select the “Email” tab and look for more. So you look to see if you can automate it somehow. You check your app's built-in integrations and search for any Zapier integrations. No luck. But you notice. To recover your Facebook account or change the password, try this: Enter the email you used to sign up for Facebook or your phone number to search for your. Import your email To search for a specific person on LinkedIn mobile web, type their name into the search bar at the top of the LinkedIn homepage. You can. 1. You can search for people on Instagram by email by using the search bar on the website. · 2. You can find people on Instagram by email by. Adding a link to your Stories is easy. When creating the Story, click on the “sticker” option, and search for “link.” This will give you the option to add a. You can view official Instagram emails sent within the last 14 days from your Settings. Type the username or real name of the person you want to follow (if you know their username, it'll make your search much quicker). The app will recommend. What are the easiest methods to find someone's Instagram email?

"Discover a simple way to find emails on Instagram. Unlock powerful tools for efficient email searches and outreach. Try it now! Note that you must be logged into your account to view your Instagram account history. You can view your Instagram account history and review all the changes. If you didn't sign up for Facebook or Instagram with a phone number, then there will not be an email address associated with your account, but you can add one. If you don't see the username, you can search for it through the Instagram search function. To streamline the process, we recommend following a user before. 1 Look for the Email button. · 2 Google them. · 3 Check their Facebook Page. · 4 Browse their website. · 5 Find them on LinkedIn. · 6 Try other social media. No, Instagram currently has no feature in its search to find someone's profile using an email. However, you can use third-party tools or contact them directly. If you know the username, email address, or phone number that's tied to their Instagram account, just hit the Forgot Password link on the Instagram login page. If you forget or don't know your Instagram username, you can still log in using your phone number or email address associated with your account. By combining Instagram with email marketing, you can get the best of both worlds. Plann has the answers you're searching for! Here are our top seven. Note: Mobile numbers and email addresses are always private on your Instagram accounts. You can remove a confirmed mobile number or email address from your. If all else fails, you can use email lookup tools available online to try to uncover the user's email ID. These tools allow you to search for email IDs. Search by usernames, full names, emails, phone numbers, and bio word matches;; Specify the research with the in-built filters;; Discover users to keep in touch. TURN HASHTAGS INTO PROSPECTS. Kendo Email Finder will help you find email address behind instagram profile. AUTOMATE YOUR INSTAGRAM SEARCH AND FIND. If you have a legitimate reason for needing to access the email address associated with a fake account, you can try reaching out to Instagram support. Explain. Google them. · Type the person's name (or anything else you think might appear in the person's Instagram bio) into the search box. · Type a space, and then type. Instagram does not have an official support email address. However, there is an official id that you can reach out to report security issues with your account. Input the details of the Instagram email you want. You can scrape multiple files at a time. 3Start Instagram Scraper. Just click Start and Instagram Scraper. So you look to see if you can automate it somehow. You check your app's built-in integrations and search for any Zapier integrations. No luck. But you notice. If someone has your email address or phone number in their contacts, they may find your account when they upload those contacts to X. Your account may also. Open the Instagram application and tap on the search bar. · Search for the person you wish to track activities and click on their profile. · You can view their.

What To Sell On Ebay To Make Money Fast

To be successful on eBay, you need to start with two things: Products that you can source for a good price and that have a large potential market, and listings. Both options have the potential to earn you a decent income. But you should definitely pinpoint the types of items you'd like to sell by committing to a. The things that sell quickest on eBay are personal electronics, cameras, mobiles phones, computers and jewelry. Basically, any product that is in high demand. This book will show you how. It's written for ambitious people who want the quickest way to make money on eBay. New sellers always earn less than seasoned sellers, even when selling the exact same items. Buyers on eBay trust sellers who've been around for a while and have. I sold items on ebay while working my full time job as a teacher for 2 years, and I made thousands of dollars putting in very little time. These tips will help. How to Make Money on eBay: $$ a Month Flipping Items Part-Time · Setting Up Your eBay Profile, Store and Understanding Fees · Purchasing Items to List and. Reselling used items is where eBay first made its name as a business. Here you can sell your old electronics, clothing, video games, books — almost anything you. Make money selling on eBay. Sell your items fast—millions of buyers are waiting. You can even watch how other sellers are pricing their items, or use Best. To be successful on eBay, you need to start with two things: Products that you can source for a good price and that have a large potential market, and listings. Both options have the potential to earn you a decent income. But you should definitely pinpoint the types of items you'd like to sell by committing to a. The things that sell quickest on eBay are personal electronics, cameras, mobiles phones, computers and jewelry. Basically, any product that is in high demand. This book will show you how. It's written for ambitious people who want the quickest way to make money on eBay. New sellers always earn less than seasoned sellers, even when selling the exact same items. Buyers on eBay trust sellers who've been around for a while and have. I sold items on ebay while working my full time job as a teacher for 2 years, and I made thousands of dollars putting in very little time. These tips will help. How to Make Money on eBay: $$ a Month Flipping Items Part-Time · Setting Up Your eBay Profile, Store and Understanding Fees · Purchasing Items to List and. Reselling used items is where eBay first made its name as a business. Here you can sell your old electronics, clothing, video games, books — almost anything you. Make money selling on eBay. Sell your items fast—millions of buyers are waiting. You can even watch how other sellers are pricing their items, or use Best.

When discussing selling on eBay vs Etsy, many people claim that it is much more straightforward on Etsy. Also, listing creation is faster compared to eBay. Yet. If you selling these, if you want to sell more of them, sell them on eBay, Amazon, and your own website. If you just choose eBay, well you miss out these, your. I made a $ profit in from selling used products on eBay. Clothes, electronics, board games — you name it. How to sell. From listing to getting paid—we provide the selling expertise to help you sell and earn more. Page navigation. Home · Selling; How to sell. Ebay is the quickest and easiest way to make extra money on the side. In today's lesson, I'm sharing the exact items I sell on eBay to make $$ a month. I sold items on ebay while working my full time job as a teacher for 2 years, and I made thousands of dollars putting in very little time. These tips will help. Choose the Top Selling Items on eBay · Sign up for eBay · Look for the product you want to sell · Search that product on Google and e-commerce sites · Set the price. Whether you want to make some extra cash, clear out unwanted items from around the house, or even start a business, it's easy to start selling on eBay. If. Making money on eBay can be done without spending a dime. Lots of people do it, mostly by rooting through their attics and garages, even refrigerators, to find. When thinking of the top-selling items on eBay, you may come up with some obvious contenders, such as collectible toys, action figures, jewelry, watches. For starters, it's fast. eBay lets sellers create an auction easily and cash in within a week. Second, it doesn't cost much to set up shop and begin selling. Top selling items on eBay · Toys & Hobbies · Sports Memorabilia, Cards & Fan Shop · Collectibles · Sporting Goods · Jewelry & Watches · Coins & Paper Money · Computers. Tennis shoes are one of my favorite things to sell. I've done well selling Old Jordans. Other types of shoes, such as running shoes, will also make you some. Whether you want to make some extra cash, clear out unwanted items from around the house, or even start a business, it's easy to start selling on eBay. Perfumes. Fragrances are a best-selling item, from beginner-friendly options to popular brands that can enchant a room with magical scents. Make-Up. Open a PayPal Account. PayPal allows your buyers to use a credit card or a checking account to pay for the items they buy from you. It also allows you to sell. This book will show you how. It's written for ambitious people who want the quickest way to make money on eBay. These days, people are often looking for ways to earn some extra money on the side. But did you know that there could be items lying around in your house. 7 small items you can sell on ebay for profit: · Remotes · Board Game Parts · Video Games & Accessories · iPods · Handheld Games · Belt Buckles · Point and Shoot. There are two ways to price your items on eBay, and both of them involve research: Use eBay completed & sold listings filters, and look for average prices; Use.